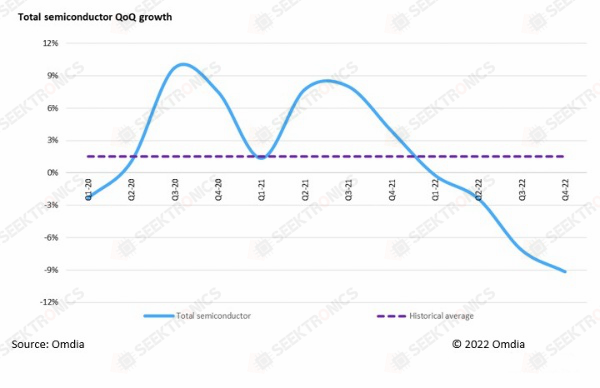

In 2022, the semiconductor market reached an all-time high with total revenues of $595. 7 billion, slightly higher than the record revenue of $592.8 billion in 2021. But with four consecutive quarters of decline, the semiconductor market is by no means having a record year in its current state, according to a new research survey by Omdia. fourth quarter 2022 contracted 9 percent from the previous quarter, the largest drop in the current economic downturn. fourth quarter 2022 revenue was $132.4 billion, just 82 percent of fourth quarter 2021's record quarterly revenue of $161.1 82 percent of the record quarterly revenue of $161.1 billion in the fourth quarter of 2021.

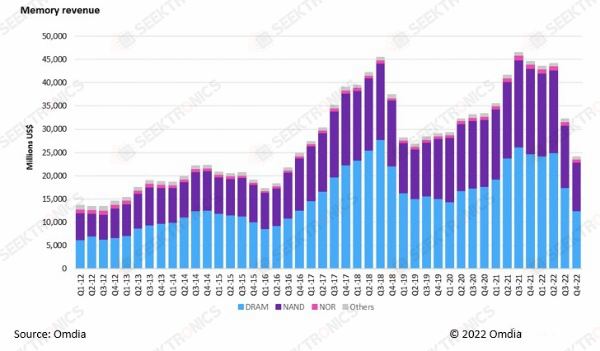

In 2021, revenues grew at double-digit rates in all major application areas, from 11% in the wireline communications industry to 36% in semiconductors for the consumer electronics industry. record revenues in 2022 were mixed, with the automotive semiconductor market growing 21% year-over-year. On the other hand is the data processing segment, which declined 6 percent year-over-year due to weakening market demand for PCs and other applications. The memory market has been hit the hardest during the current economic downturn. It reached a record $46.5 billion in the third quarter of 2021, while in the fourth quarter of FY21, revenues were only 52% of that figure, bringing in only $24.1 billion.

Lino jeong, senior principal analyst of DRAM, commented: "The sharp decline in memory market sales can be attributed to the following three reasons. One, with the end of the new crown epidemic, information technology demand will rapidly decrease. Two, excess inventory due to record high investments by memory manufacturers at the inflection point of demand. Three, macroeconomic contraction and slowdown in IT demand due to central bank interest rate hikes. In particular, in the fourth quarter of 2022, prices fell sharply as suppliers tried to expand sales to reduce excess inventory. Omdia estimates that the trend will continue in the first quarter of the year."

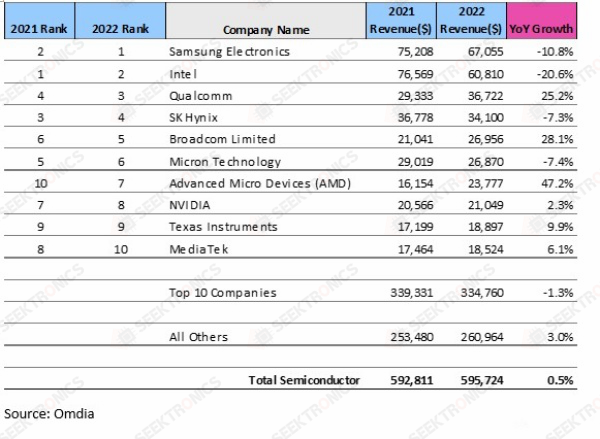

The top two semiconductor companies in terms of revenue remain in the top two, but their revenues are collectively nearly $24 billion lower than in 2021. Among the top five, memory companies - SK Hynix and Micron - both slipped one spot, while Qualcomm and Broadcom each moved up one spot. AMD moved up the most, by three spots compared to 2021, largely due to its acquisition of Xilinx, which added nearly $5 billion in revenue.

-20x20-20x20.png)