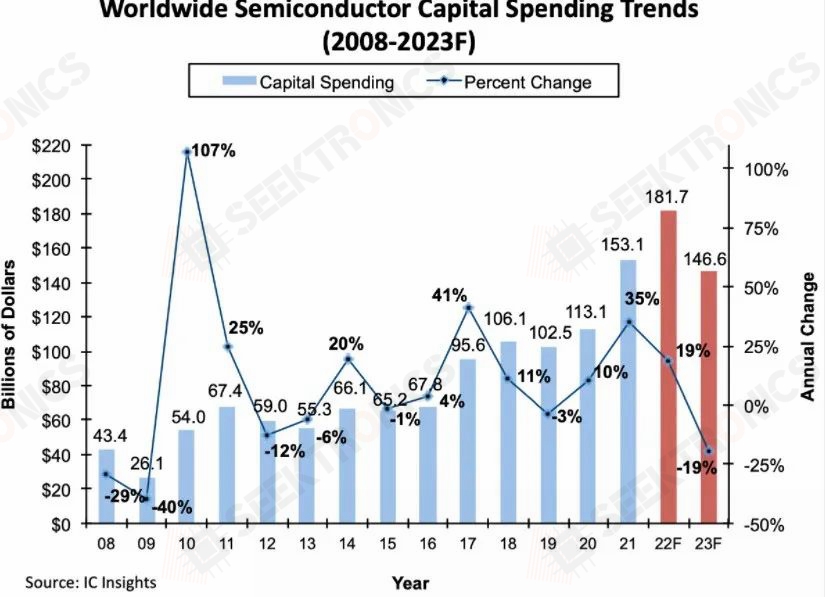

IC Insights has good news and bad news from November 24. The good news is that CAPEX will grow 19% year-over-year to a record $181.7 billion in 2022, IC Insights said. The bad news is that global semiconductor Capex is forecast to decline 19% year-over-year in 2023, which would be the biggest decline since 2008.

Semiconductor suppliers are enjoying a strong influx of orders at the start of the year due to strong post-COVID-19 economic activity. Strong demand has pushed utilization rates above 90 percent for most fabs and 100 percent for many semiconductor foundries.

In the middle of the year, however, the picture suddenly changed. Soaring inflation has quickly slowed the global economy, forcing many semiconductor makers to scale back their aggressive expansion plans.

As a result, IC Insights revised its 2022 global semiconductor CAPEX forecast to show 19 percent growth to $181.7 billion this year. The revision was down from an initial forecast of $190.4 billion and 24 percent growth. While down from the original outlook, the revised CAPEX forecast will still be at an all-time high.

In addition, IC Insights believes that the major manufacturers will reduce capital expenditure by 25 percent, which will have a big impact on memory vendors. However, nearly all semiconductor manufacturers expect demand for their products to rebound between 2024 and 2025.

As a result, manufacturers are still choosing to expand capacity to meet demand over the next decade. Chip plants already under construction or in place, including those of Intel, Micron, Samsung, Taiwan Semiconductor, and Texas Instruments in the United States, will also move forward.

In addition, IC Insights further emphasizes that government subsidies to U.S. semiconductor suppliers following the introduction of the Chip and Science Act will not significantly boost their spending in 2023. The reason is that manufacturers will use the subsidies they receive to invest in new capacity expansion.

-20x20-20x20.png)