How long till the chip shortage ends?

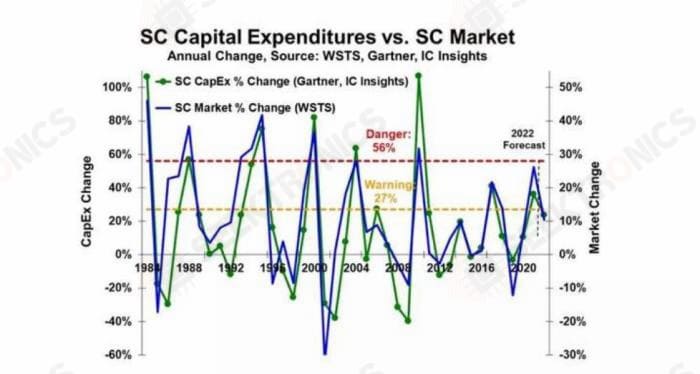

As we all know, the chip industry has a cycle, and according to the historical experience value, usually, a chip cycle is 3-5 years, and the market will be 1-2 quarters ahead of the fundamentals.

Why do cycles occur? First of all, the market demand increases, the supply exceeds the supply, the price goes up, then the fabs increase production, increase capacity, and the chip industry continues to rise, and this is the upcycle.

As capacity grows, there is a problem, which is that supply slowly exceeds demand, so inventories are high, prices fall, and eventually, there are fewer fabs, and you enter a downward cycle.

Until after the production cut, the market supply and demand relationship are balanced, slowly short of supply, then the chip price began to rise, into the upward cycle.

Throughout the decades of chip history, the industry has been up - down - up - down... Periodic fluctuations.

So the question arises, what stage is the chip industry currently in?

We all know that this wave of chip increase, should start from the fourth quarter of 2020, starting from automotive chips, and then spread to all the chip industry chain, IC growth, wafer growth, encapsulation growth, equipment growth, materials, etc., the price of the wildfire blow endless.

From the fourth quarter of 2020 to the third quarter of 2022, it has been eight quarters, or two years, or half of the entire chip cycle.

So this is also consistent with the historical pattern. Since the third quarter of 2022, we have seen a decline in the chip industry, including CPU decline, GPU decline, DRAM decline, NAND decline, analog chip C decline, as well as semiconductor equipment and materials decline.

Looking at the overall trend, the agency forecasts that global semiconductor CAPEX will reach $185.5 billion in 2022, up 21% year on year.

But in 2023, global semiconductor CAPEX will fall by about 26% to $138.1 billion.

In terms of the scale of the global semiconductor industry, a considerable number of institutions believe that 2023 will record the largest decline since 2001, reaching more than 15%.

In the history of the chip industry, only three of the last 50 years -- 1975, 1985, and 2001 -- have seen double-digit declines, with 2001 being the worst year of all, falling 32%.

This is to say, 2022 is at the beginning of the decline of the chip industry, in the middle of the slope, the worst will be in 2023, may fall to the bottom.

According to historical rules, by 2024 at the earliest or the end of 2023, the market will be the first to feedback, and there will be signs of upward movement.

However, it is also clear that since 2020, the fabs are the world's largest expansion, but also necessarily accompanied by the largest de-stocking, so whether the completion of the indicators as promised, the cycle inflection point is not yet clear, there may be many variables.

-20x20-20x20.png)